A pump in the context of cryptocurrencies means a rapid and significant increase in the price of a certain cryptocurrency in a short period of time. This is usually due to the grouped effort of a large number of traders and investors who buy up the cryptocurrency at the same time, which causes the price to rise. If you know exactly when pumping is due, you can make good money. You can learn about reliable Crypto Pump Signals on Binance from the Telegram channel on the OBZOROFF.INFO website.

Where it Crypto Pump, How it Works

Cryptocurrency pumps are usually carried out within certain communities, where the organizers publicly announce the start of the pump and encourage participants to invest in a particular cryptocurrency. The goal of the organizers is to create the illusion of a quick profit in order to attract new investors and exit the position with maximum profit.

Risks and legality

It is important to note that cryptocurrency pumps are high-risk transactions and are often associated with market manipulation and fraud. Although some investors can make money on pumps, most participants lose their investment.

Cryptocurrency pumps can be illegal, especially if they are organized scams. Different countries have different laws and regulations governing cryptocurrencies, and pumps may conflict with these laws. Check local laws and regulations before engaging in such transactions.

How much can you earn on pump crypto?

Cryptocurrency pumping earnings can be potentially high, but it is also associated with a high risk of losing funds. During a pump, the price of a cryptocurrency can increase significantly in a short period of time, which allows some investors to earn multiples of the profits.

However, there are several factors to consider:

Not all pumps are successful: Many pumps fail and investors lose money. Pumps are often market manipulation and pump organizers can oversell their holdings while newbies invest and buy their holdings.

Entry and exit times: In order to make money on the pump, it is important to get inside before the price rises and get out before it collapses. Determining these time points with high accuracy is extremely difficult, and many traders fail to time their operations.

Liquidity and Volume: Some pumps are run on low-liquid and obscure cryptocurrencies, which means that it can be difficult for you to sell your assets at a bargain price due to limited demand.

Fraud risk: Many pumps are associated with fraud and illegal activities. You should be careful and check the reliability of the organizers of the pampas and the compliance of the operation with local laws.

As a result, although some investors manage to make money on cryptocurrency pumps, this is a high-risk operation, and most participants lose their funds. In general, pumps are not recommended as a reliable way to invest. Conscious investigation and caution is recommended when engaging in such operations. It is better to stick to more reliable and solid investment strategies.

Definition of the concept of “cryptocurrency pumps”

Cryptocurrency pumps are a way to manipulate the cryptocurrency rate in order to quickly grow it and then sell it for a profit. Cryptocurrency pumps are based on an organized group of individuals who agree to simultaneously buy a large amount of a certain cryptocurrency in order to create artificial demand and raise its price.

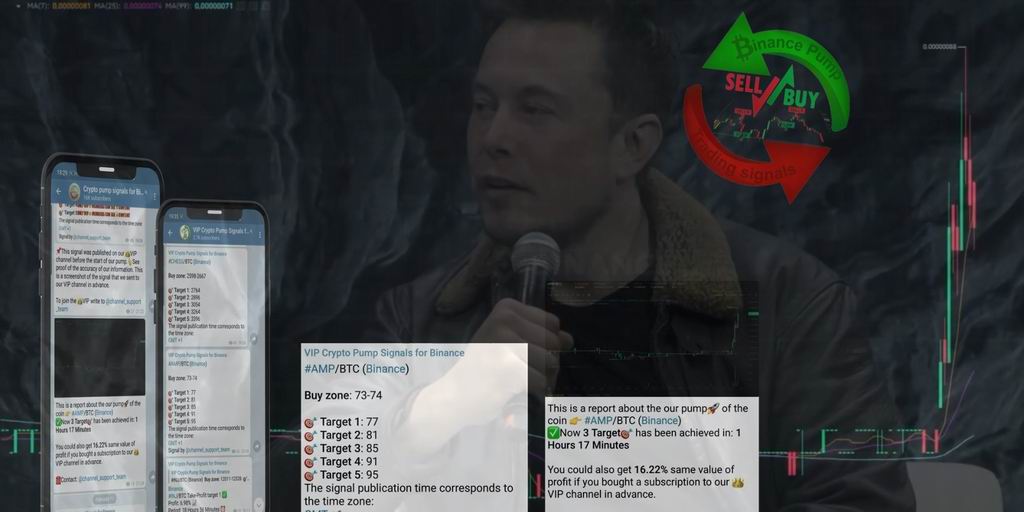

To conduct cryptocurrency pumps, special groups are used in messengers or social networks, where participants receive information about upcoming pumps and instructions on how to buy a certain cryptocurrency. Usually, before the pampas start, the community agrees on the exact time and price at which everyone should make a purchase.

As soon as the purchases are made and the rate of the cryptocurrency has risen, the organizers of the pampas begin to sell their coins at a profit on the open market, causing the market rate to fall. As a result, pampa participants who did not have time to sell their coins may suffer significant losses.

Cryptocurrency pumps are a form of market manipulation that is especially prevalent in the world of cryptocurrencies due to their high volatility. Many regulators and experts consider pumps to be illegal activities that can cause serious damage to the market and participants who are not familiar with such practices.

In general, cryptocurrency pumps are unscrupulous and risky manipulations in the cryptocurrency market, which can lead to irreversible financial losses for participants who do not have sufficient experience and knowledge. Therefore, before participating in such events, it is recommended to fully understand all the risks and consult with professional investors or financial advisors.

How cryptocurrency pumps work

Cryptocurrency pumps (or pumps) are events organized by a group of investors aimed at deliberately artificially increasing the price of a certain cryptocurrency. The main purpose of pumps is to profit from price growth and sell assets at an inflated value.

The principle of operation of cryptocurrency pumps begins with the formation of a community or a group of investors who agree to take part in organizing a pump. Next, the pump participants determine the target cryptocurrency and set a specific time for the operation.

During the pump, the organizers actively advertise the chosen cryptocurrency, creating demand and fueling interest in it. Then, at a predetermined moment, they simultaneously buy large amounts of that cryptocurrency, causing its price to skyrocket in the market.

After reaching the goal – increasing the price of the chosen cryptocurrency – the organizers begin to sell assets with a huge profit. As a result, other investors involved in the pump also try to sell their assets, hoping to get the maximum profit. This can lead to a sharp drop in the price of the cryptocurrency, after which many investors will lose money.

The organization of cryptocurrency pumps has many ways: it can be the creation of special communication channels, the use of blockchain platforms, anonymous forums and other means of communication. Cryptocurrency pumps are considered illegal and unethical as they create distortions in the digital asset market and deceive ordinary investors.

Pros and cons of cryptocurrency pumps

Cryptocurrency pumping is a strategy in which a group of people conspire and massively buy a certain cryptocurrency in order to artificially increase its price. This practice has its pros and cons, which should be considered before participating in pampas.

Advantages of cryptocurrency pumps:

Earning Opportunity: Pump participants who managed to buy cryptocurrency in time before the pump and sell it at the peak can make a significant profit.

Rapid Price Changes: Pumps can cause the price of a cryptocurrency to skyrocket in a short amount of time, allowing you to capitalize on quick changes.

Acquisition of active knowledge: participation in pumps requires in-depth study of the cryptocurrency market and analysis of signals, which can increase financial literacy.

Disadvantages of cryptocurrency pumps:

High Risk: Pumps are high-risk transactions, because after the rise in the price of a cryptocurrency, a collapse usually occurs, which can lead to a loss of investment.

Uncontrollable nature: The organization and results of pumps are highly dependent on the actions of the participants, which can lead to manipulation and unexpected changes in plans.

Limited opportunities: it is not always possible to see and take part in the pump in time, which reduces the chances of making a profit.

So, participation in cryptocurrency pumps has its pros and cons. Before deciding to invest in pampas, it is necessary to carefully analyze the risks and take into account all the factors associated with this strategy. This will help to avoid possible losses and increase the chances of success.